Despite widespread belief that conservatives are better for the economy, evidence suggests otherwise. Economic experts, including those from Goldman Sachs, warn that Trump's economic plan could lead to increased inflation. Additionally, many analysts argue that under Project 2025's proposed tax plan, low- and middle-class Americans would end up paying more, while the ultra-wealthy and corporations would see their tax burdens decrease. The plan also includes a consumption tax and new tariffs on China, which could negatively impact everyday Americans and small business owners by raising the cost of goods.

Goldman Sachs has publicly stated that Kamala Harris would be better for the economy.

Trump's economic plan would increase inflation

Trump has a pretty low success in his business ventures. He filed Chapter 11 Bankruptcy four times. His Casino Bankruptcies screwed his workers out of retirement savings.

Trump Bankruptcies

- 1991: Trump’s Taj Mahal

- 1992: First of two Atlantic City casinos owned by Donald Trump.

- 1992: Second of two Atlantic City casinos owned by Donald Trump.

- 1992: Trump’s Plaza Hotel in New York City

- 2004: Trump’s Hotels and Casinos Resorts

- 2009: Trump’s Entertainment Resorts

During the 2016 campaign, Hillary Clinton asserted that Trump filed for bankruptcy relief six times, Trump countered with a count of four. This discrepancy may stem from how Trump interprets his 1992 filings—whether he sees them as one event or as three separate cases. The accurate count for that year would be three, whereas Trump may consider it a single larger occurrence.

Casino Bankruptcies

Trump's Tax Cuts did NOT help the middle class. Project 2025 wants to increase taxes for the average American family through a consumption tax. Trump also doesn't know how Tariffs work.

In the video, economic experts Brendan Duke and Casey Mulligan discuss the implications of shifting the U.S. tax system toward a more consumption-based model. They explore how this could impact revenue generation and the overall economy.

Tariffs and the Economy

Mulligan argues that tariffs could contribute to federal revenue, but questions how significant that impact would be, emphasizing that many goods Americans purchase are domestic. He suggests that tariffs function as an investment tax rather than purely a consumption tax.

Trump's tax cuts would hurt low and middle income earners, which could harm economic growth.

Duke points out that proposed tax cuts predominantly benefit high-income earners, moving the revenue system from income taxes toward consumption taxes, which would disproportionately affect low- and middle-income families. He warns that this shift might harm economic growth.

TRUMP DOES NOT KNOW HOW TARIFFS WORK.

Tax Loopholes and pushing the burden to families

The conversation also touches on President Trump’s tax proposals and the potential challenges of implementing a consumption tax, noting that such a system could still be riddled with loopholes. Ultimately, they conclude that while a consumption tax might streamline revenue collection, it could leave many families worse off due to increased overall tax burdens.

Trump wasted billions of dollars in taxpayer money for pipeline projects

Dominion Energy and Duke Energy cancelled the Atlantic Coast Pipeline, wasting taxpayer money without putting pipe in the ground

The Keystone XL Pipeline (Northern Leg) - The Keystone Pipeline Already Exists

The United States produces more crude oil than any nation at any time for six years in a row, and has especially flourished under Joe Biden

“The profits of the top five publicly traded oil companies, for example — BP, Shell, Exxon, Chevron, and TotalEnergies — amounted to $410 billion during the first three years of the Biden administration, a 100% increase over the first three years of Donald Trump’s presidency, according to data compiled by Reuters.” See the chart here.

This is in addition to Biden’s investing in clean energy infrastructure.

If you watch conservative educational videos from PragerU, you can see how they leave out critical facts (like Putin’s invasion of Ukraine, as stated in their cited source) to persuade voters that fossil fuels, and not renewable energy, is the answer. They are blaming energy shortages on green energy policies instead of international conflict and sanctions.

Trump claims he created more jobs than Biden. In a month-by-month comparison, Trump only had higher numbers for TWO MONTHS

Trump’s Golf Trips Cost Taxpayers Over $340 Million. Trump's LIE that the election was stolen has cost taxpayers $519 million (and counting)

Only about a third of the $800 billion of PPP loans went to workers who would have otherwise lost their job.

Only about a third of the $800 billion went directly to workers who otherwise would have lost their jobs. Most of the money ended up in the hands of business owners and shareholders.

Over one billion dollars went to businesses that are now closed (from 2020).

Every job saved by PPP loans cost taxpayers between $170,000 and $257,000, which is nearly double what Biden’s student debt forgiveness would have.

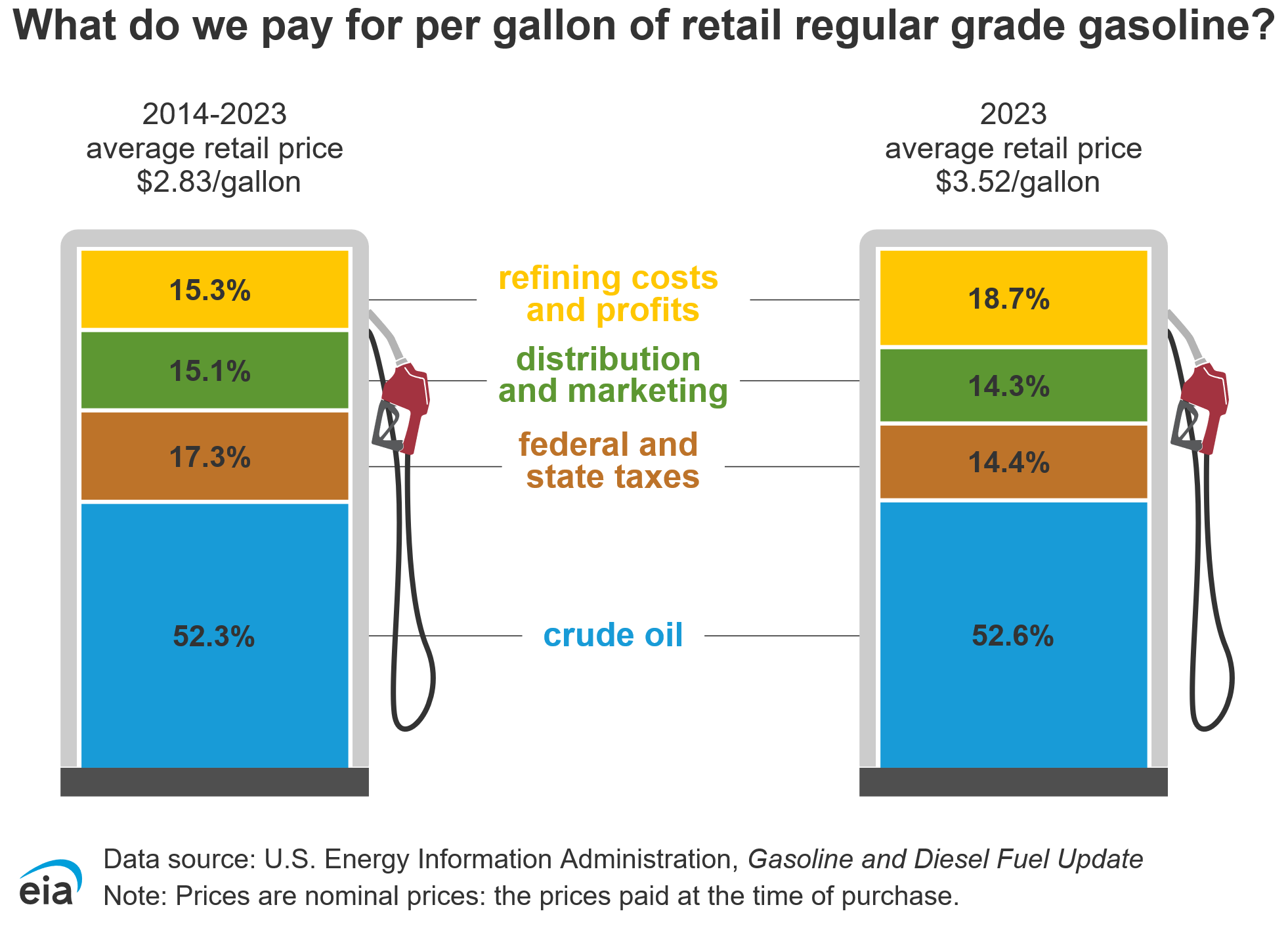

Right-Wing media unfairly blamed Biden for gas prices and praised Trump for lower prices during the pandemic. Presidents don't set gas prices, and many people were not travelling during the pandemic.

The retail price of gasoline is primarily driven by the cost of crude oil, which fluctuates based on various factors, including U.S. oil production. Government taxes also play a significant role, with a federal tax of 18.40 cents per gallon and an average state tax of 32.44 cents as of January 2024.

Additionally, refining costs and profits vary seasonally and regionally due to different gasoline formulations required for air quality. Prices often rise in summer when demand increases. Distribution and marketing costs contribute to the final price, with gasoline transported from refineries to terminals and then to retail stations.

Retail costs can differ widely based on location, competition, and the operating expenses of individual gas stations, such as wages, rent, and insurance. These factors collectively influence the price consumers see at the pump.

Gas prices rose this time, predominantly due to Russian oil sanctions from the Ukraine War.

Project 2025 wants the FHA (Federal Housing Administration) to Increase the Mortgage Insurance Premium for 30 year home loans

Project 2025 wants to incentivize people taking shorter loans for homeownership (removing 30 year mortgages), preventing even more people from buying a house

Project 2025 Wants to RAISE student loans, eliminate the SAVE program, eliminate income-driven repayment plans

The removal of the SAVE plan would have a significant negative impact on young parents and couples who rely on it to manage their monthly debt payments. Currently, this plan allows them to make more affordable payments, which helps them maintain financial stability. If these payments were to increase, it could severely limit their ability to save for major milestones, such as purchasing a home. Given that many young people are already struggling to enter the housing market, heightened financial pressure from increased debt payments could push homeownership further out of reach. This situation not only affects their immediate financial health but could also have long-term implications for their ability to build wealth and secure a stable future.

Trump complains about a worker shortage, but Project 2025 wants to incentivize women staying home to care for children, and suggests having employers cover the cost of childcare. Project 2025 also wants to allow religious employers to legally discriminate against women & LGBTQ+

According to Project 2025, Congress should incentivize on-site childcare and have the employer should burden the expense. If you've worked for any large retail corporation, know how this went when employers needed to cover health insurance costs. They scheduled most employees under the 30 hour requirement to receive benefits. Project 2025 wants to push women of childbearing age out of the workforce.

Project 2025 wants to eliminate overtime pay as it currently exists.

Congress should provide flexibility to employers and employees to calculate the overtime period over a longer number of weeks. Specifically, employers and employees should be able to set a two- or four-week period over which to calculate overtime. This would give workers greater flexibility to work more hours in one week and fewer hours in the next and would not require the employer to pay them more for that same total number of hours of work during the entire period.

Project 2025 wants to Privatize the National Weather Service and repeal climate change initiatives. This will decimate crops, bankrupt farmers, make food more expensive, and increase homeowners insurance prices in disaster-prone areas like Florida.

Project 2025 wants to privatize the national weather system, which would lead to people needing to subscribe to a service to find out the temperature or whether to bring an umbrella with them when they leave their house.

This would also negatively impact farmland and rural food producers that rely on weather apps to take care of their crops.

Project 2025 also wants to defund weather infrastructure like the planes that fly into hurricanes, preventing us from learning about these storms that are only able to get worse as waters in the gulf get warmer. This will negatively impact homeowners insurance rates in coastal states from Texas to the northeast and make it even harder for people to afford to insure their own homes. This is already happening in Florida.

Trump hired the former CEO of AccuWeather, Barry Myers, to be the head of the Oceanic and Atmospheric Administration during his first term. Myers does not have a science degree. Project 2025 mentions AccuWeather in their manifesto.

Project 2025 wants to enforce work requirements for people receiving federal benefits like food stamps. Project 2025 also wants to ban abortion. This combination would harm children's well-being and the ability for single mothers to take care of their children.

Some are obvious and long-standing goals like eliminating marriage penalties in federal welfare programs and the tax code and installing work requirements for food stamps. But we must go further. It’s time for policymakers to elevate family authority, formation, and cohesion as their top priority and even use government power, including through the tax code, to restore the American family.

Project 2025's policies appear to disproportionately affect single mothers, as they propose implementing work requirements for individuals receiving food assistance. Additionally, the initiative seeks to restrict access to abortion services. These measures could significantly impact children living in single-parent households, potentially making it more challenging for them to access essential nutrition and other basic needs.

Project 2025 wants to ensure that only poor (BELOW 185% OF THE FEDERAL POVERTY LINE) kids can have free lunches at school

Heritage Foundation research from 2019 found that after the enactment of the Community Eligibility Provision (CEP) in 2010, the share of students from middle- and upper-income homes receiving free meals in states that participated in CEP doubled and in some cases tripled—all in a program meant for children from families with incomes at or below 185 percent of the federal poverty line (Children from homes at or below 130 percent of the federal poverty line are eligible for free lunches, while students from families at or below 185 percent of poverty are eligible for reduced-priced lunches).

Conservative perspectives on school lunch programs have increasingly framed them as problematic. Project 2025 seeks to limit assistance primarily to low-income children, while also proposing significant changes to nutrition guidelines that would reduce standards to what is deemed essential for basic survival. This approach raises concerns about the adequacy of support for those who depend on school meals for their daily nutritional needs.

Project 2025 wants to deregulate the meat and dairy industry, raising the likelihood of bird flu and other livestock illnesses, and the death of people.

Listeria Outbreak - Boars Head

The widow of a 79-year-old man, Otis Adams Jr., filed a wrongful death lawsuit against Boar's Head and Publix after he allegedly contracted listeriosis from eating Boar's Head ham, leading to his death. This case is notable as it is the first to connect a death to deli meat other than liverwurst in the ongoing listeria outbreak, which has resulted in 59 hospitalizations and 10 deaths across 19 states.

Judith Adams, the widow, claims negligence and breach of contract, seeking unspecified damages. The listeria outbreak has primarily been associated with liverwurst, which Boar's Head has since discontinued following inspections that revealed unsanitary conditions at its Virginia plant. In total, Boar's Head recalled 7 million pounds of various deli meats due to contamination concerns.